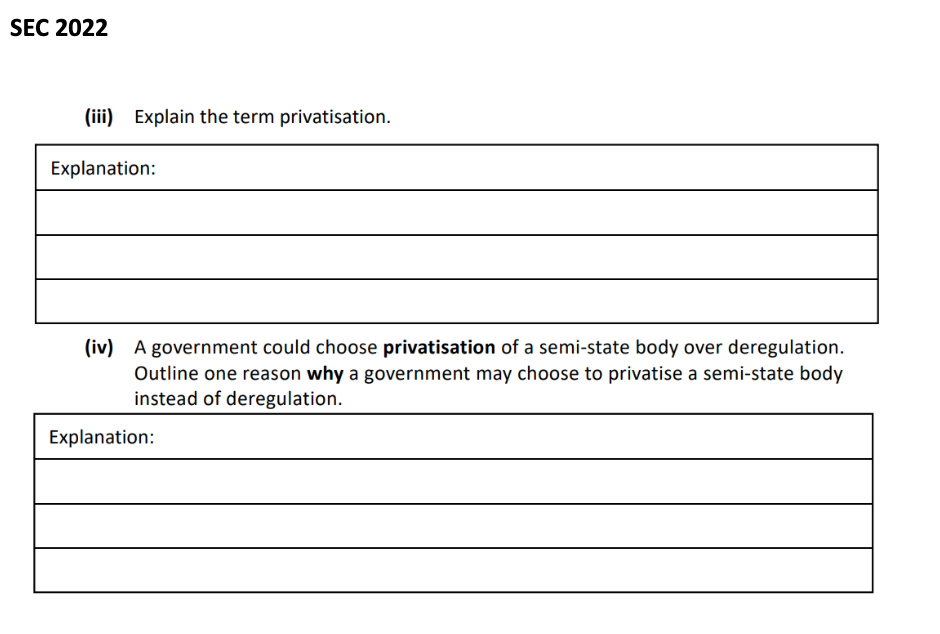

Definition: The selling of a state owned company / asset in whole or in part to the private sector

- Student workpoint: Find five previously state owned firms.

Possible economic arguments for may include:

Revenue for government: The government could use the revenue from the sale of the asset to reduce its level of borrowings into the future.

More competition: Competition in the industry could improve services offered to customers and lead to more competitive prices for goods and services e.g. air travel in Ireland/Aer Tricity, Energia due to ESB infrastructure being privatised.

Employment opportunities: In the case of a new firm, if it increases its market share, then this may result in a growth in employment together with additional job security for existing employees. International Airlines Group (IAG) purchase of Aer Lingus.

Enterprise culture: Increased share ownership may lead to growth in an enterprise culture within the country and so help employment.

Access to finance/overseas markets: Through the sale of additional shares on the stock exchange, private companies have access to extra finance. Companies can expand overseas and compete for business abroad.

Greater incentives for innovation: nEmployees may have more incentive to innovate and improve productivity as they may reap greater rewards for their innovations within the privatised sector e.g. higher bonuses.

Less pressure on the government finances:There is no further requirement for on-going government investment in the company and the government can still have some control through regulation.

Possible economic arguments against may include:

Increased Prices/ falling standards of service: The quality of services provided by the new company may deteriorate in an effort to save costs. Prices may be increased to increase revenue.

Loss of jobs and reduced job security: Jobs may be lost through rationalisation of services and this may lead to higher social welfare costs.

Loss of a State Resource / loss of annual profits: Taxpayers lose critical infrastructure, which was once owned by the state. The state will lose profits made by profitable state firms. Loss of control e.g. Bord Gais (retained the pipeline network).

Foreign Ownership: With the sale of a state owned asset, overseas buyers may become the owners of an Irish company and so control of the asset may go outside the state. National Lottery and Aer Lingus.

Cost of the Sale: During the privatisation process, all costs in preparation for such a sale, legal work etc. must be paid for by the taxpayer.

Curtailment in pay and pensions increases: The owners of the newly privatised company may limit pay and pension increases due to its employees or change its employees’ conditions of employment resulting in a worsening of these.

Loss of essential public services: The newly privatised firm may cut those services which are non-profit making and this may affect lower income groups in particular. Eg, Buses may not be provided in rural areas or hospital closures if they don’t have enough patients

Possible abuse of monopoly power: If the newly privatised company is in a monopoly position it could abuse its power and increase prices

Irish Examiner: Fergus Finlay: Privatisation, Irish style, has robbed us of our most precious assets