Irish Budget: See newspaper article: At a glance: Here are the key points from Budget 2023 (RTE, 2022)

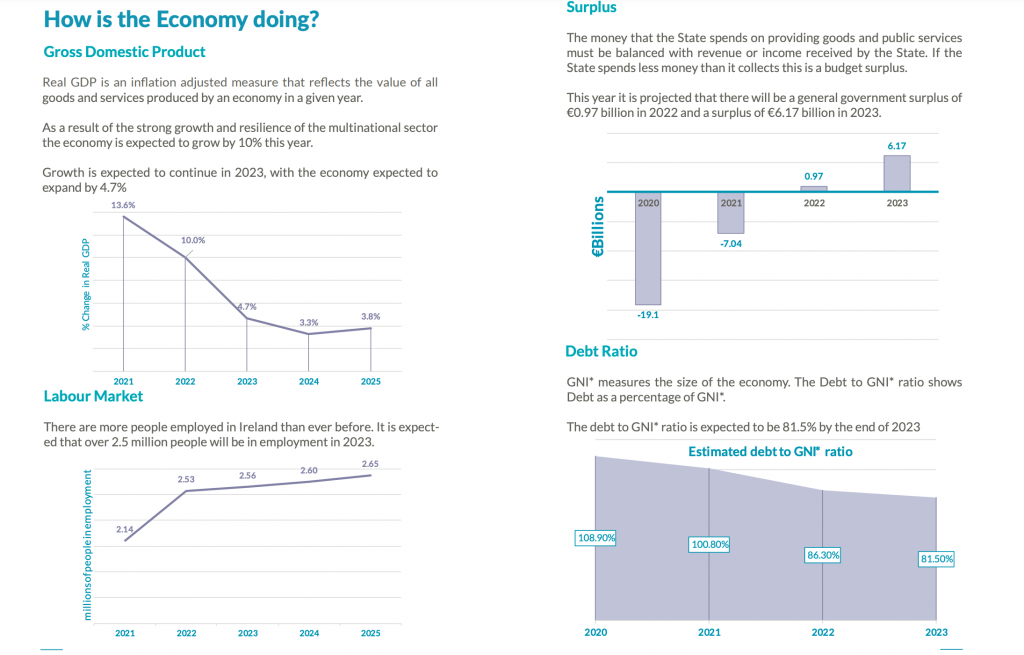

- Current Budget Deficit: : government current revenue is less than government current expenditure

- Current Budget Surplus: government current revenue is greater than government current expenditure

- Balanced budget: government current revenue is equal to government current expenditure

Consequences of Current Budget deficit

- The national debt rises as the government spends more than it takes in. This money has to be paid back with interest for the future.

- A deficit can cause the economy to overheat, as governments spend more money (injects more than is leaked). This causes inflation.

- The economy is more vulnerable to economic shocks as there is no surplus set aside in the event of such a shock in the future.

- Can cause higher economic growth if the government is injecting more than it withdraws.

Consequences of Current account surplus

- The surplus can be used to reduce general government debt and reduce future costs of servicing debt.

- economic growth is lower than it would otherwise be as the government withdraws more money than it injects.

- A surplus can help reduce pressure on prices (inflation). It can reduce demand.

- surplus can be set aside for future shocks. eg. Covid 19 crisis.