Learning Outcomes

2.2 The consumer (Demand)

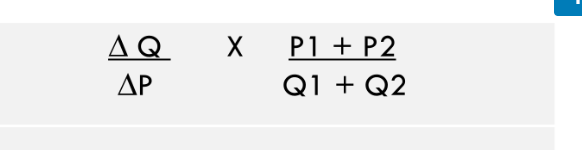

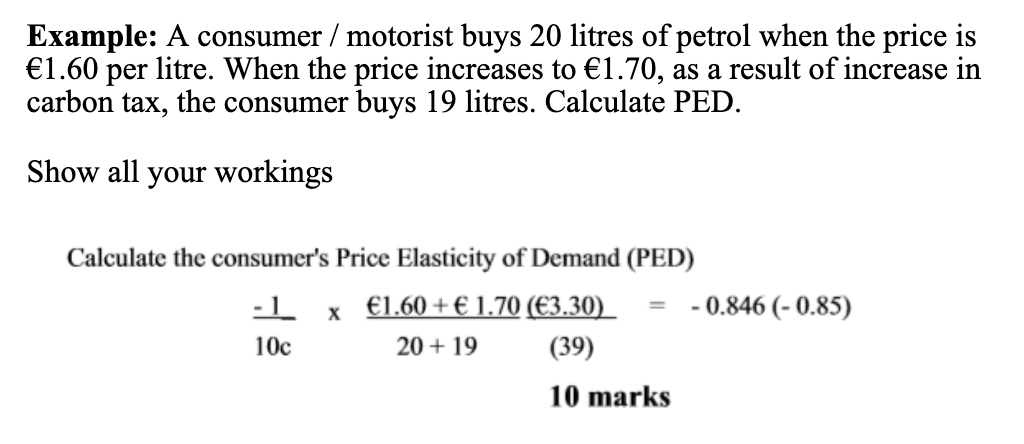

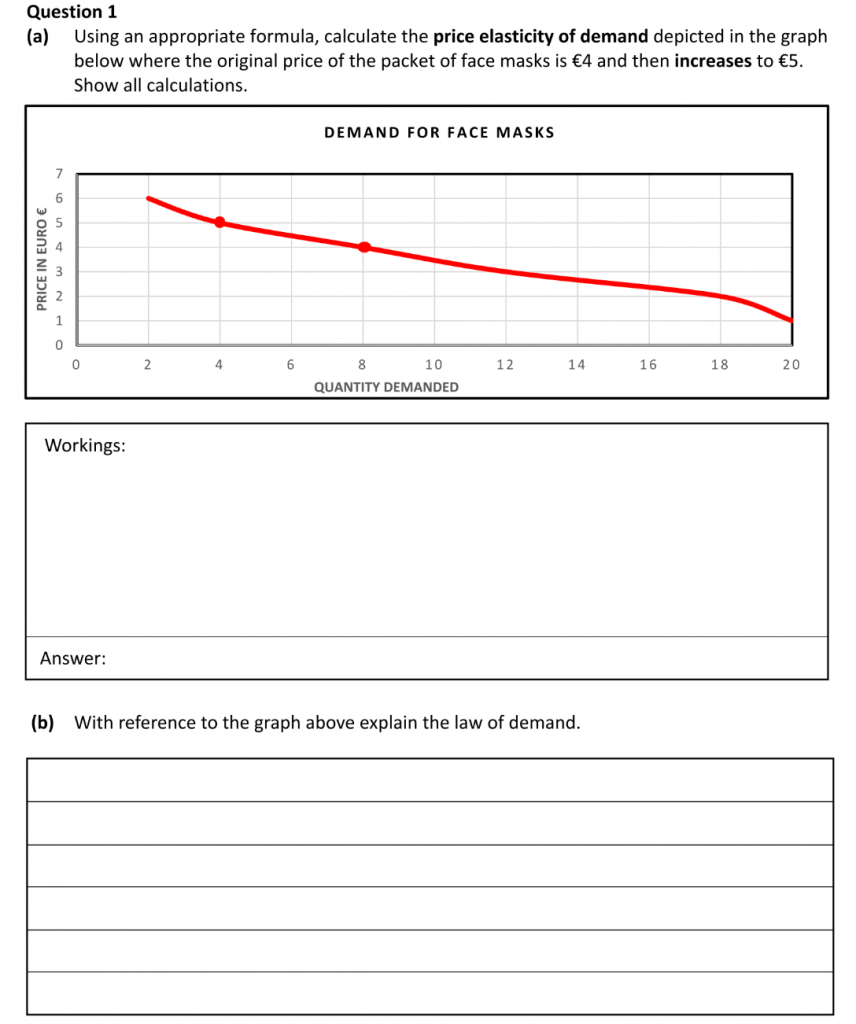

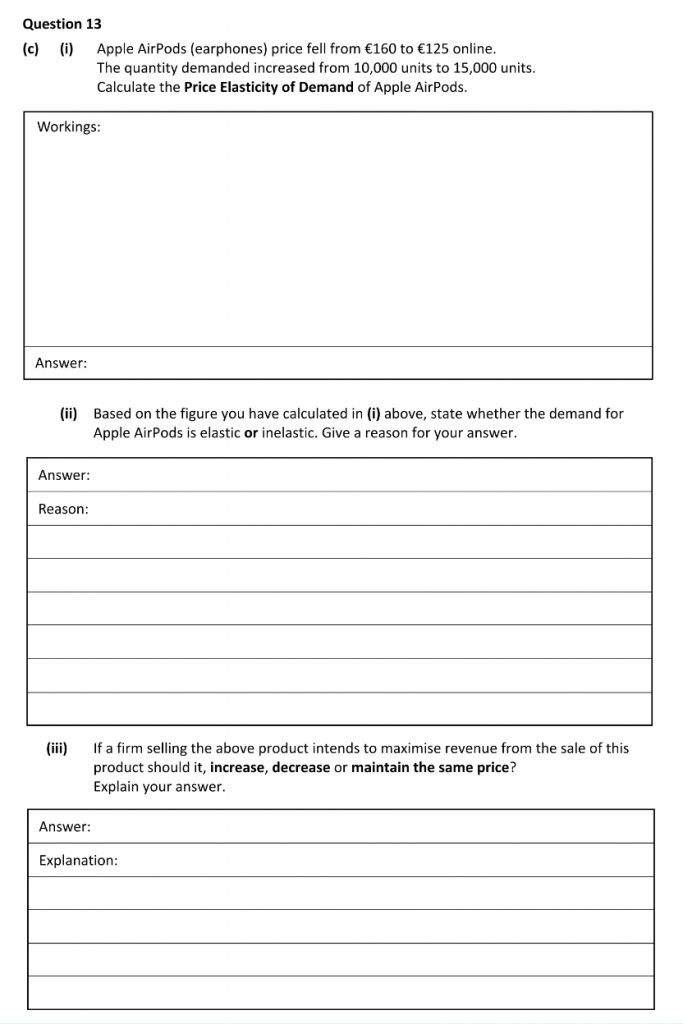

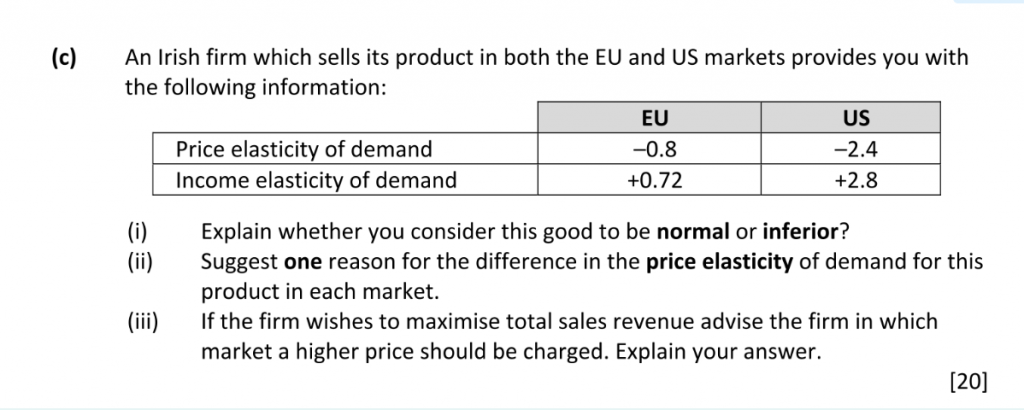

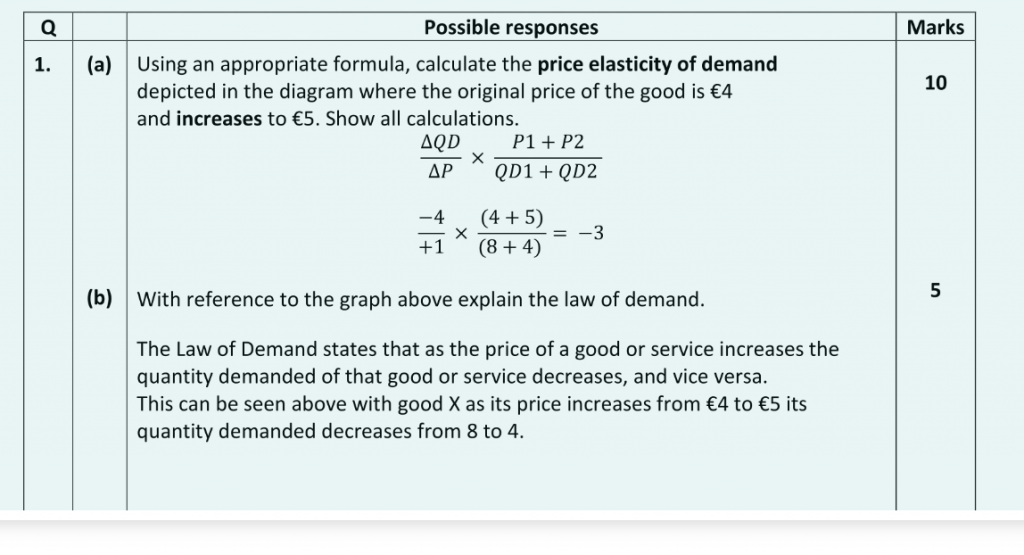

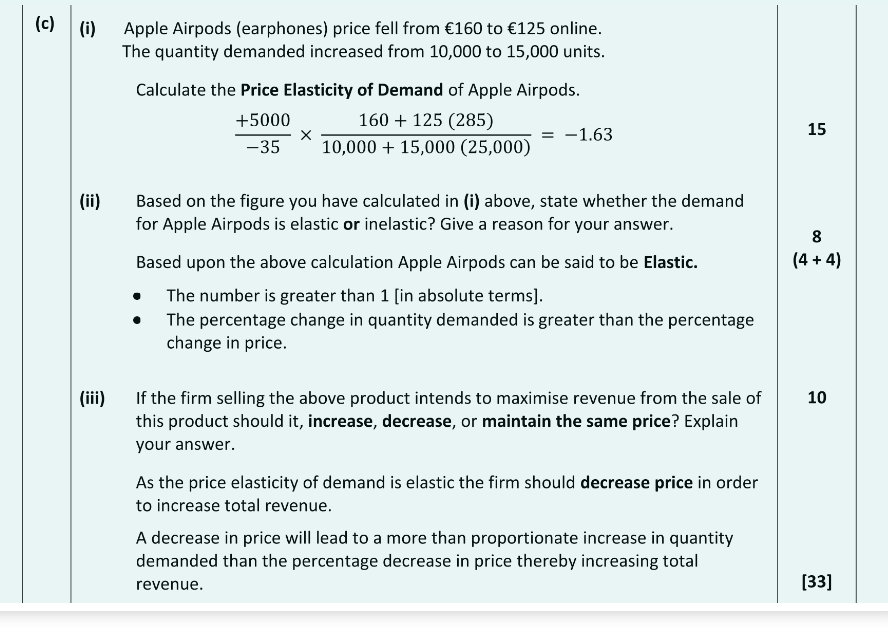

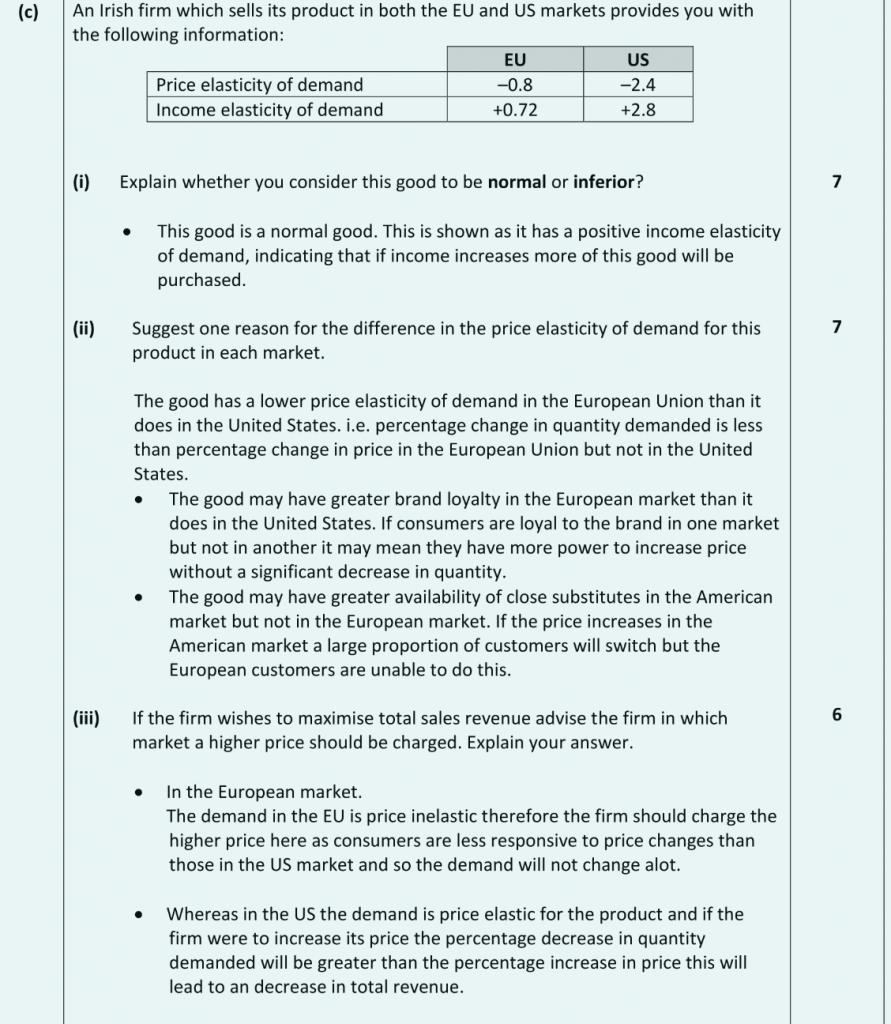

- Using data, calculate Price Elasticity of Demand (PED) and Income Elasticity of Demand (YED) using a formula

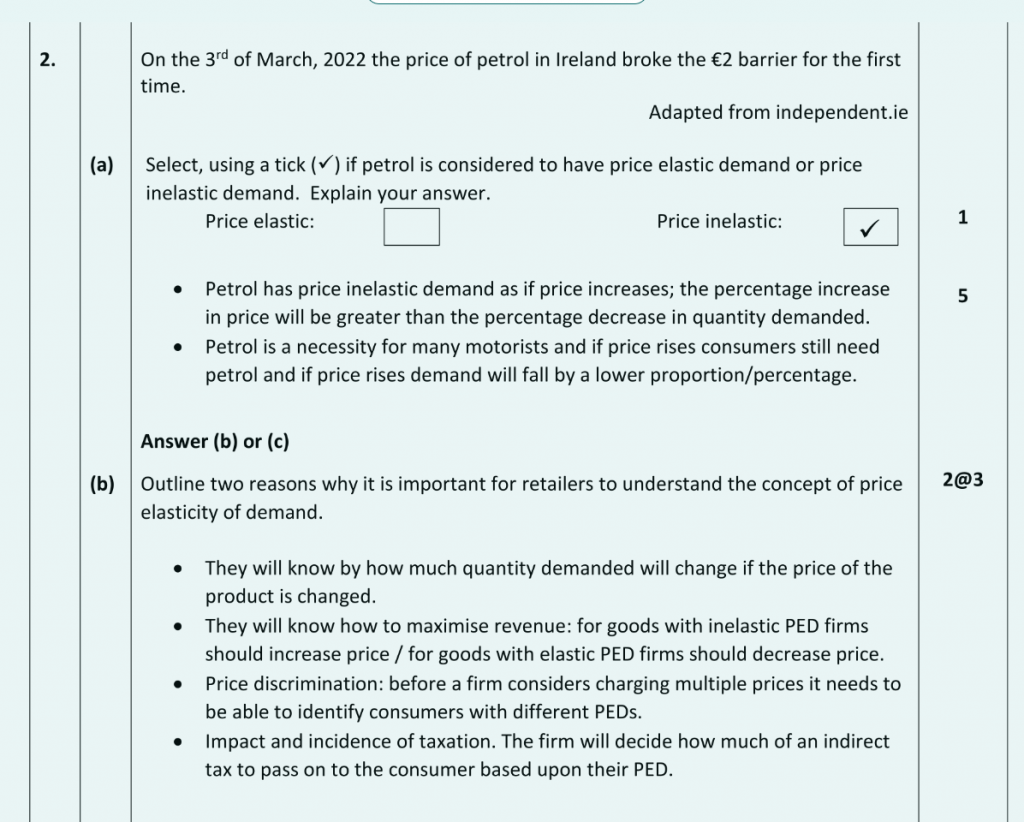

- Evaluate how PED and YED can be used by individuals, firms and the government to help predict the impact of pricing on revenue/sales

- Investigate and interpret data patterns in Irish consumers’ current expenditure

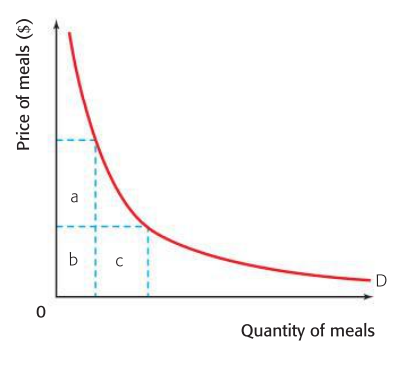

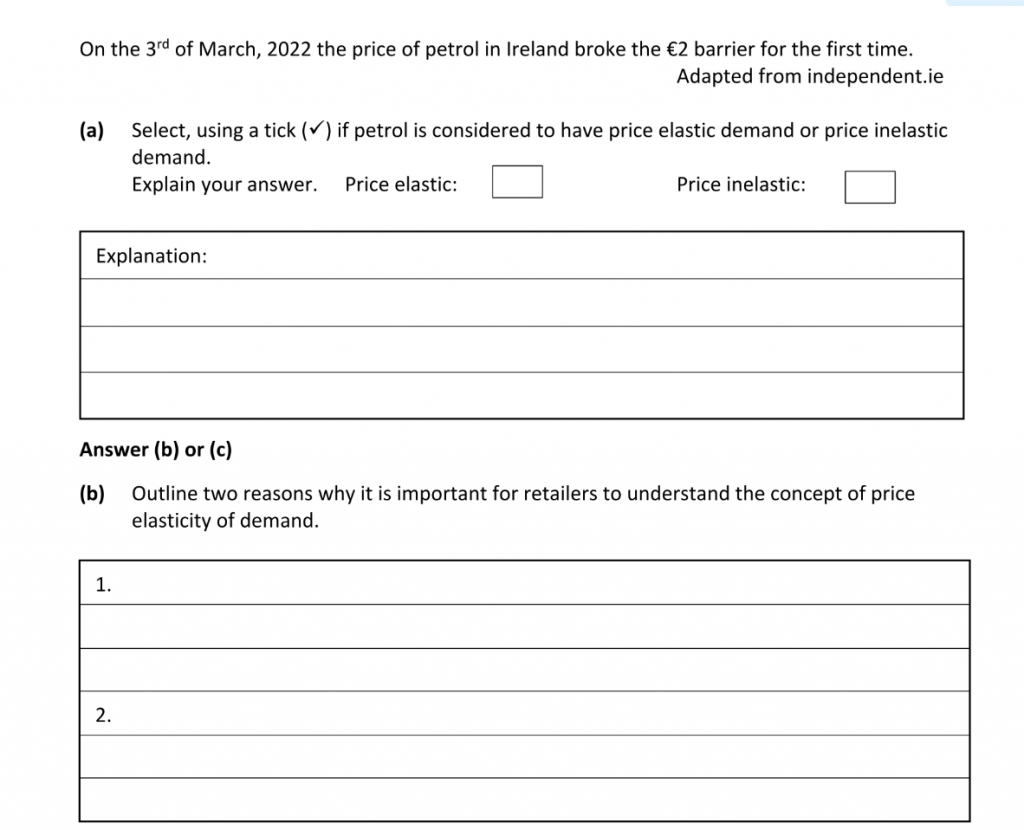

Price Elasticity of Demand

Definition: Price elasticity of demand is a measure of the responsiveness of the quantity demanded of a good or service when there is a change in its price. (Video on PED).

Student activity: Consumer buys 50 units of a product when the price is €1.50. When price is reduced to €1 consumers buy 90 units. Using appropriate formula, calculate consumers PED. Show your workings.

The Ranges in Value of PED

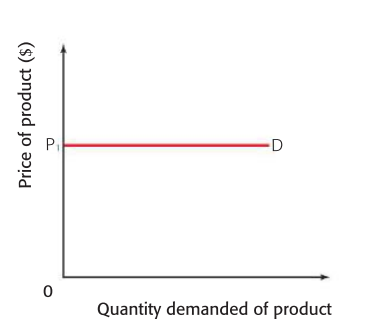

(PED = Greater than 1)

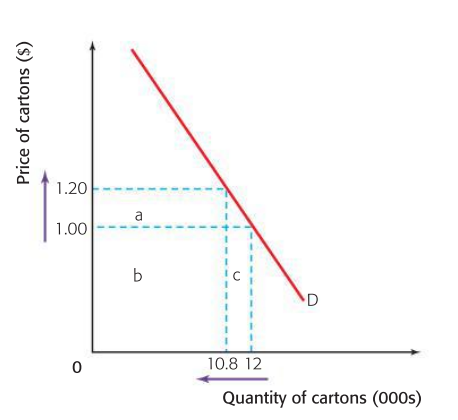

Elastic Demand: The percentage change in price will be LESS than the percentage change in quantity demanded. Coefficient greater than 1 (-2.0 / – 1.1 / +2). If producer wishes to maximise revenue they must decrease Price.

Why? The percentage increase in demand exceeds the percentage decrease in price

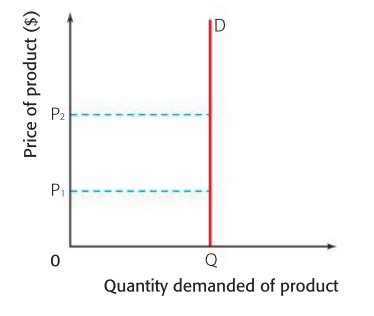

(PED = less than 1)

Inelastic Demand: The percentage change in price will be GREATER than the percentage change in quantity demanded. Coefficient greater less 1 (-0.9/ – .1 ) If producer wishes to maximise revenue they must increase Price.

Why? The percentage decrease in demand exceeds the percentage increase in price.

Determinants of PED

- The number/availability of close substitutes: When a good has a close substitute and its price is increased, the demand for the good will be elastic because people will switch to the cheaper substitute. When a good has no substitutes and its price is increased, as there are no alternatives, it will be inelastic. Consumers are not responsive to change in price. Eg. Soft drinks such as Pepsi have many close substitutes (coke, sprite etc), so are elastic.

- The proportion of income which is spent on income: In general, the greater the amount of your income that is spent on a good, the more elastic the demand of this good is likely to be in response to a change in price. Eg. An increase in 50% in price of a box of matches is unlikely to have a significant effect of demand for it as it is only about 1% of income.

- The length of time allowed for adjustment to price changes: The longer the price change persists, the more responsive (elastic) the response will be. At first, the consumer will be inelastic, (not responsive) but as time goes on the consumer will become elastic (responsive) to a change in price. Eg. A consumer may not be responsive to a rise in the price of electricity rates in the short term, but in the long term will consider alternatives and change electricity suppliers

- The durability of the good: The more hard-wearing the good is, the more elastic the demand. Eg. If there was an increase in the price of cars, it is likely that the public will extend the life of their existing car and postpone purchase of replacement.

- Number of alternative uses good has: The more uses a good has, the more elastic the demand. Eg. Sugar is used for sweetening purposes, baking, food processing etc. any increase in price of sugar may only result in small fall in demand in each market, but overall fall may be significant and so price will be elastic.

- Nature of the good: When a commodity is a necessity like food grains, vegetables, medicines, etc., its demand is generally inelastic as it is required for human survival and its demand does not fluctuate much with change in price. Luxury goods will be more elastic.

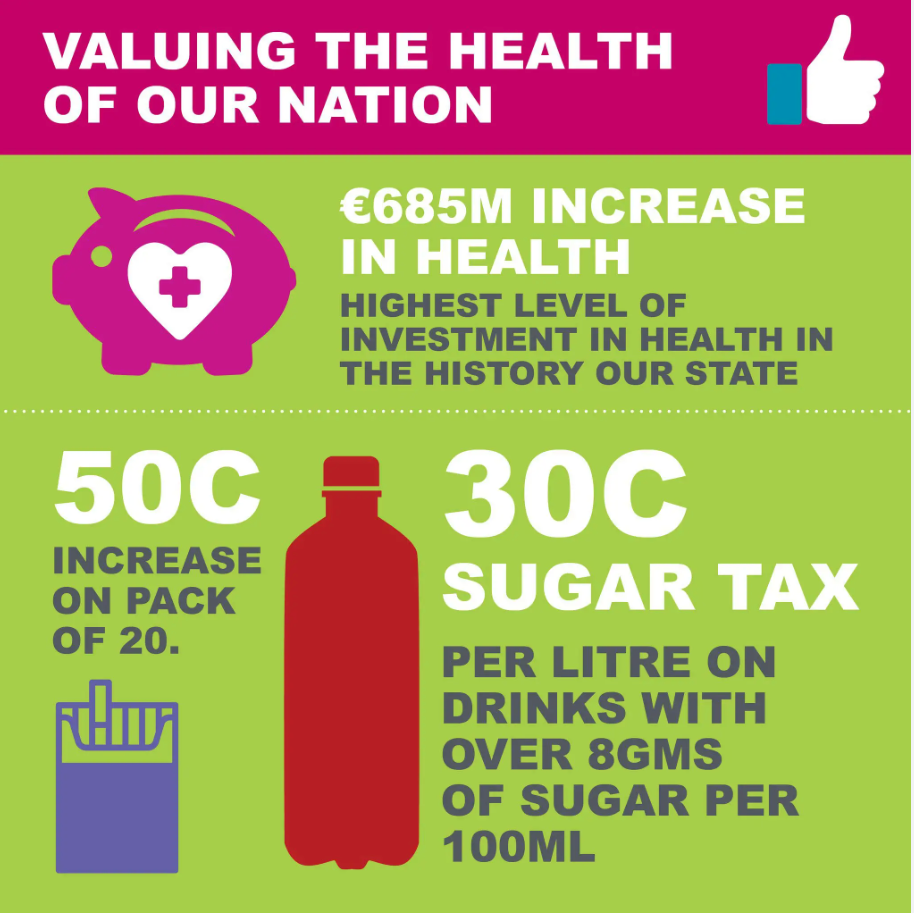

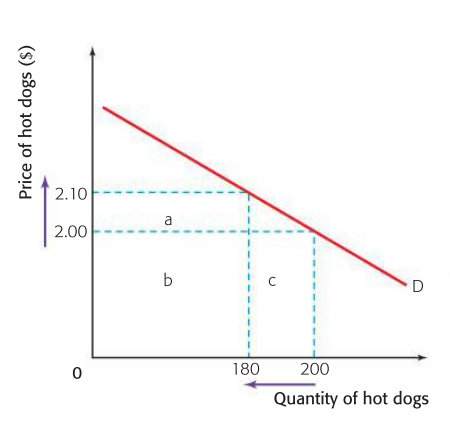

PED and Taxation (Government and Businesses)

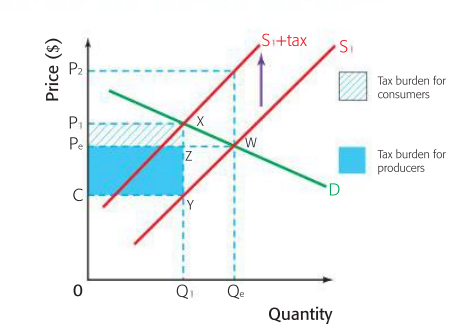

When a government imposes an indirect tax, like a sales tax, on a product, it typically causes the product’s price to go up. The impact of this tax on the product’s demand depends on how responsive consumers are to changes in price, which is measured by PED.

Elastic Goods: If a product has very elastic demand (i.e., consumers are sensitive to price changes), then a tax-induced price increase will result in a relatively large fall in the demand for the product. This can lead to a significant fall in total revenue (PxQ=TR). In turn, the number of people employed in the industry falls.

The burden of the tax will fall more on the consumer than the producer.

Inelastic Goods: If a product has inelastic demand, a tax-induced price increase will result in a relatively small decrease in the demand for the product. This means that people will continue to buy the product even if the price goes up due to the tax. In such cases, the industry may not experience a significant reduction in employment, and the impact on unemployment in the broader economy is likely to be less pronounced.

Tax Revenue Assurance: By taxing goods with inelastic demand, governments can secure a more reliable source of tax revenue. Since consumers are less likely to reduce their consumption significantly in response to price increases, the government can anticipate a steady stream of tax revenue from these goods. This is especially important for funding essential services and public expenditures.

Research opportunity

Research Sugar Sweetened Drinks Tax (SSDT) in Ireland and consider the following.

- How much is the tax on Sugar Sweetened Drinks?

- Who benefits from the tax

- What stakeholders suffers from the tax?

- Is the tax effective?

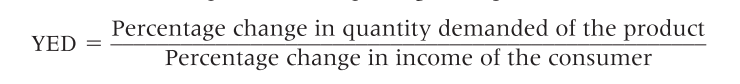

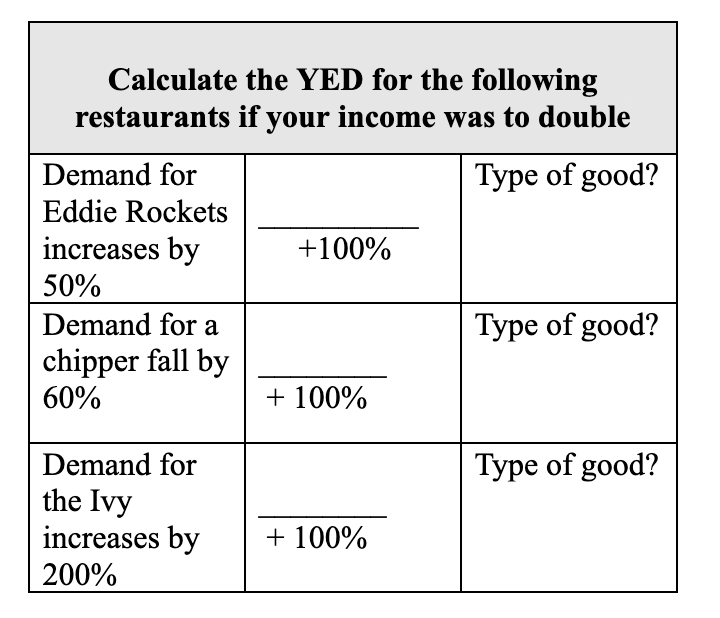

Income Elasticity of Demand

Definition of Income Elasticity of demand (YED): Measures the percentage change in the quantity demanded for one good caused by a change in consumers income. (Watch video here).

Normal good: YED is positive, as income increases quantity demanded increases (Y↑, Qd↑)

Necessity goods: YED is low. The demand for them will change very little if income rises. For example, the demand for bread does not increase significantly as income rises, because people feel that they already have enough bread and so will not increase consumption.

Inferior good: YED is negative, as income increases, quantity demand falls Y↑, Qd↓)

People start to switch their

expenditure from the inferior goods that they had been buying to superior goods, which they can now afford. For example, the demand

for inexpensive jeans falls as income rises because people switch to buying branded jeans.

Consumer durables & luxuries: YED is high – demand rises greatly as income increases. YED greater than 1. (Y↑, Qd↑↑↑)

As people have more income and have satisfied their needs, they begin to purchase products that are wants, i.e. non-essential, in greater number. For example, the demand for holidays in foreign countries is likely to be income-elastic.

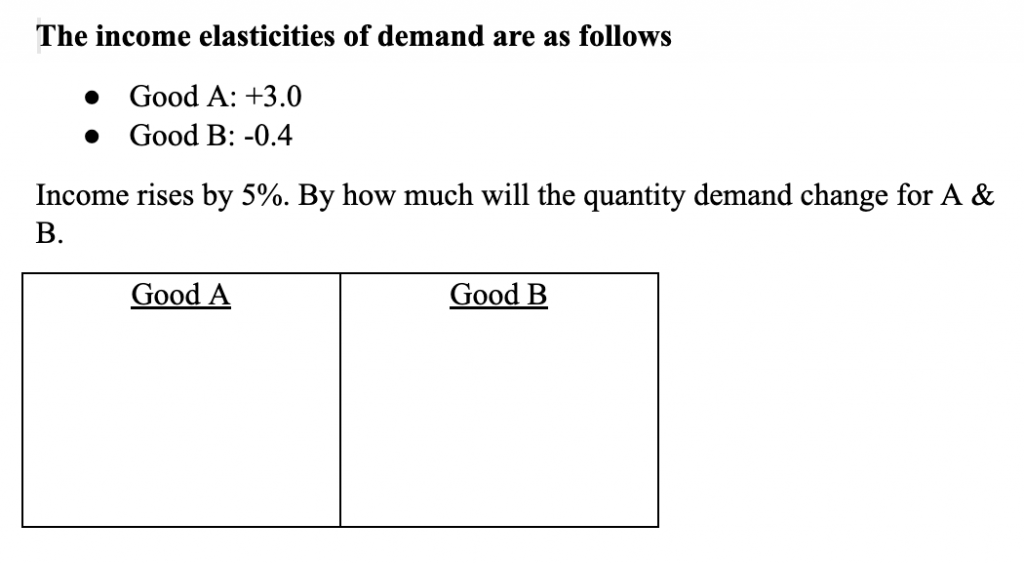

Calculate YED