Irish mirror outlines the concrete block levy in Budget 2023. Concrete block levy will offset cost of mica redress scheme, says Tanaiste Leo Varadkar

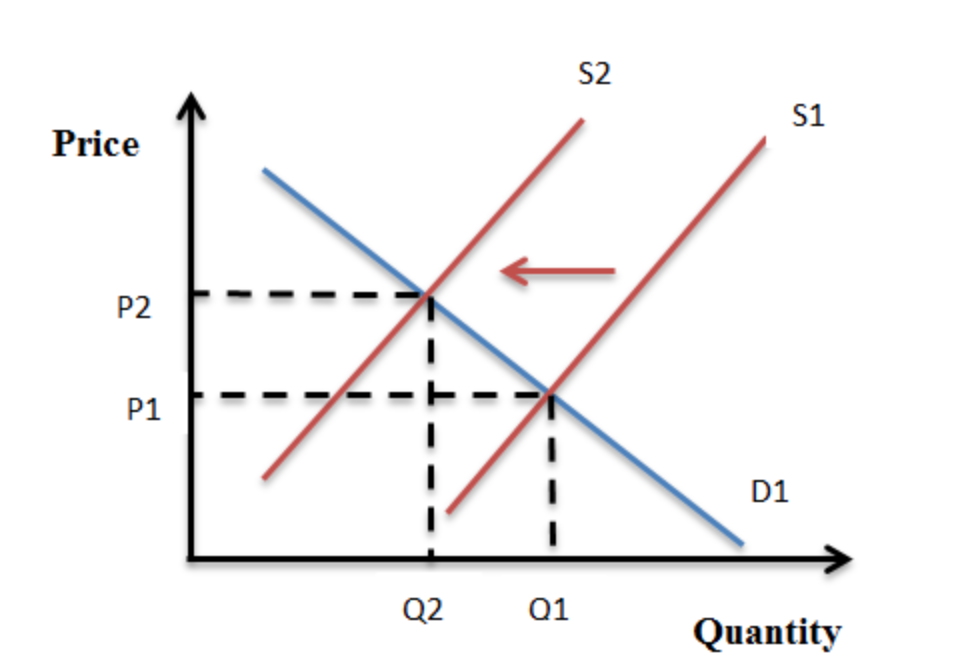

Market for concrete blocks

This government intervention will cause the price of concrete blocks to increase. Supply shifts to the left (see diagram above) from S1 to S2. Blocks also have a derived demand (the demand for a good or service that results from the demand for a different, or related, good or service). Therefore the cost of production of houses increases, leading to a fall in demand for houses at the higher cost of production.

Market failure

The reasons why the government would want to tax concrete is because it is considered a market failure. The production of these concrete blocks in a free market leads to an inefficient allocation of resources. They are oversupplied and over consumed in the free market. The production of these blocks create a negative externality of production; a cost to a third party. There is a health cost to society (the third party) created through the making and use of concrete (externality is the CO2 emissions). To fix this market failure, government intervenes to recoup the cost by taxing the concrete blocks.